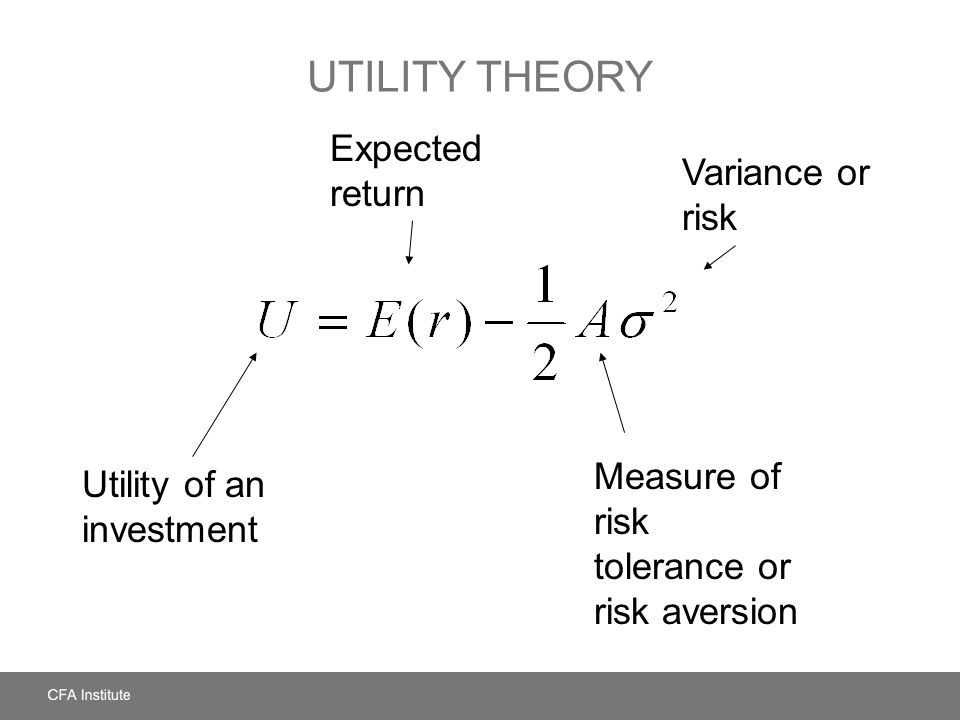

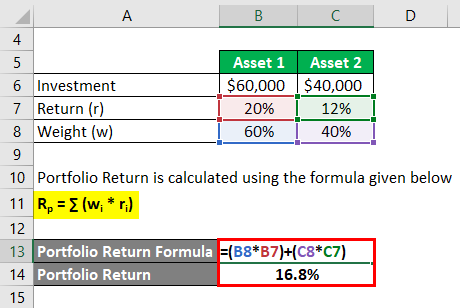

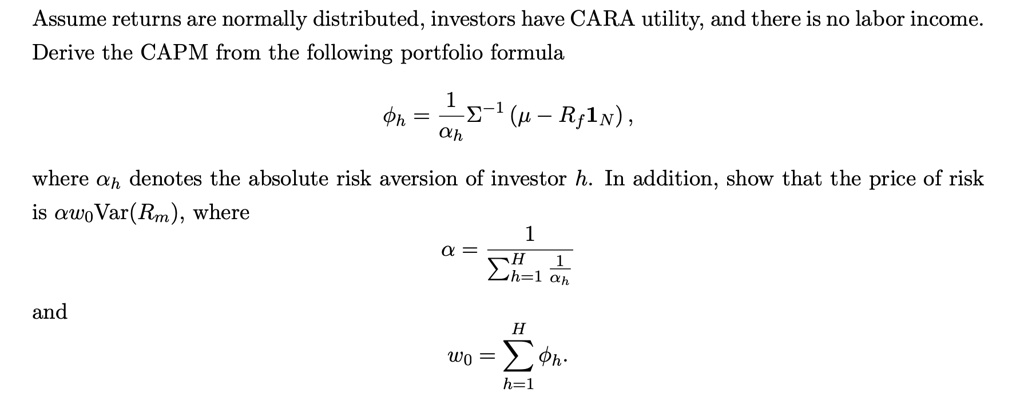

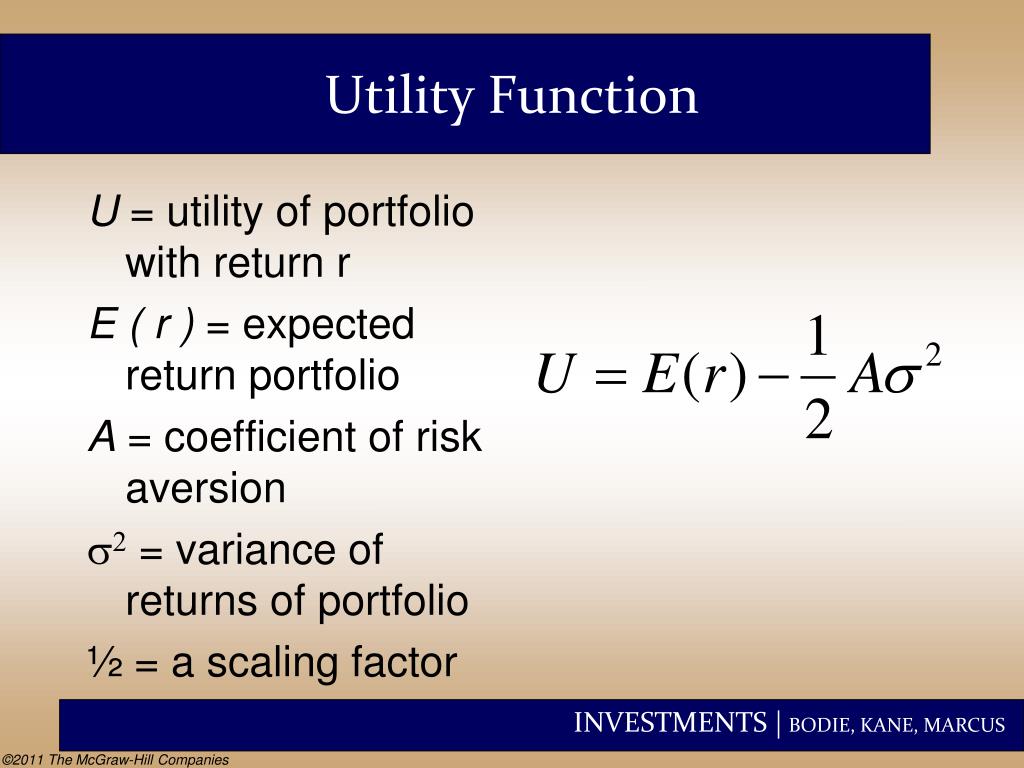

Modern Portfolio Theory: Efficient and Optimal Portfolios, the Efficient Frontier, Utility Scores, and Portfolio Betas

Modern Portfolio Theory: Efficient and Optimal Portfolios, the Efficient Frontier, Utility Scores, and Portfolio Betas

Modern Portfolio Theory: Efficient and Optimal Portfolios, the Efficient Frontier, Utility Scores, and Portfolio Betas

![PDF] PORTFOLIO SELECTION UNDER EXPONENTIAL AND QUADRATIC UTILITY | Semantic Scholar PDF] PORTFOLIO SELECTION UNDER EXPONENTIAL AND QUADRATIC UTILITY | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/84d4cb576c5dc1a159fbffa5f55640a5cb17d9ca/6-Figure1-1.png)